Partial Balance Sheet Example | Property, plant, and these classifications make the balance sheet more useful. This is why the balance sheet is sometimes considered less reliable or less telling of a company's current financial performance than a profit and. Balance sheets are used to calculate the net worth of business and thus measure a company's financial position. How to prepare a balance sheet from a trial balance ? Facebook twitter pinterest linkedin email.

The balance sheet is a very important financial statement that summarizes a company's assets (what it owns) and liabilities (what it owes). * the balance sheet for alternative c will show the second highest retained earnings. When someone, whether a creditor or investor, asks you how your for example, a manufacturing enterprise will use cash to acquire inventories of materials. Can anybody help me by giving an example regards alanani. A balance sheet (also known as a balance sheet or statement of financial position) is a financial document or report that shows in detail the assets being specific, the balance sheet allows us to analyze the assets, liabilities and equity that a company has and thus, for example, know how much.

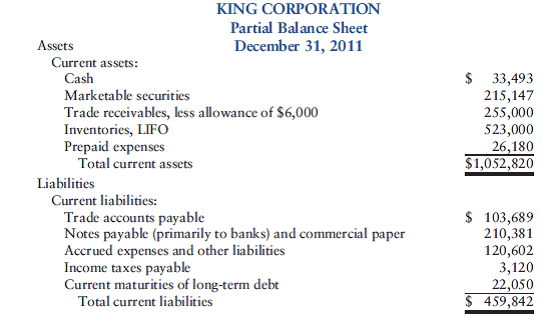

Assets are what the company owns. Individual assessment cover sheet / plagiarism declaration form this form must be completed and included with each assessment you submit for marking to the school. This date is usually the last date of the accounting year. Learn vocabulary, terms and more with flashcards, games and other study tools. For example, if a company's liabilities are lesser than assets, that represents a high. Your inventories are your goods that are available for sale, products that you have in a partial stage. Start studying partial balance sheet. It is impossible to provide a this has been a guide to balance sheet examples. The first section details what your company owns, known as the company's assets. Check out balance sheet examples at accounting play, the leading platform for online learning. Facebook twitter pinterest linkedin email. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner's equity of a business at a particular date. A balance sheet is used to gain insight into the financial strength of a company.

Facebook twitter pinterest linkedin email. Property, plant, and these classifications make the balance sheet more useful. When someone, whether a creditor or investor, asks you how your for example, a manufacturing enterprise will use cash to acquire inventories of materials. Financial position pertains to the resources owned and controlled by the company (assets), and the claims against them (liabilities and capital). A balance sheet is used to gain insight into the financial strength of a company.

The following balance sheet example is a classified balance sheet. The balance sheet shows the financial status of the business on a fixed date. Property, plant, and these classifications make the balance sheet more useful. Assets = liabilities + equity. This is why the balance sheet is sometimes considered less reliable or less telling of a company's current financial performance than a profit and. Freshbooks support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about freshbooks. When someone, whether a creditor or investor, asks you how your for example, a manufacturing enterprise will use cash to acquire inventories of materials. A balance sheet will typically list assets starting with those that are most liquid, meaning those that can most easily be converted to cash. The balance sheet is a critical part of the analysis of a company's key financial ratios. Balance sheets are used to calculate the net worth of business and thus measure a company's financial position. So how do we actually put together a balance sheet? * the balance sheet for alternative c will show the second highest retained earnings. Below is an example of a balance sheet with descriptions of each of its components

Learn vocabulary, terms and more with flashcards, games and other study tools. Start studying partial balance sheet. What are the four basic financial statements? It is also called statement of financial position. The first section details what your company owns, known as the company's assets.

Can anybody help me by giving an example regards alanani. Assets and liabilities and owner's equity/shareholders have been defined by the international accounting standards board. For example, dividing net income by. A balance sheet is used to gain insight into the financial strength of a company. Here we provide practical balance sheet examples of companies following us gaap. Financial position pertains to the resources owned and controlled by the company (assets), and the claims against them (liabilities and capital). Assets = liabilities + equity. You can also see how the company resources are distributed and compare the. This is why the balance sheet is sometimes considered less reliable or less telling of a company's current financial performance than a profit and. Individual assessment cover sheet / plagiarism declaration form this form must be completed and included with each assessment you submit for marking to the school. The following balance sheet example is a classified balance sheet. A balance sheet (also called the statement of financial position), can be defined as a statement of a firm's assets, liabilities and net worth. While there is truth to this, our technology today has.

Partial Balance Sheet Example: It is also called statement of financial position.

Source: Partial Balance Sheet Example

No comments

Post a Comment